Featured Brass Knuckles

-

2023 Classic Skull Head EDC Knuckles For Men

Regular price From $USD 84.99Regular priceUnit price per$USD 124.99Sale price From $USD 84.99Sale -

Afrankart DFK 2 Finger Brass Knuckles Ring Stainless Steel - Cakra EDC Gadgets

Regular price $USD 46.99Regular priceUnit price per$USD 66.99Sale price $USD 46.99Sale -

Brass EDC Self Defense Knuckles

Regular price $USD 94.99Regular priceUnit price per$USD 144.99Sale price $USD 94.99Sale -

2023 New Steel Knuckles

Regular price $USD 22.99Regular priceUnit price per$USD 38.99Sale price $USD 22.99Sale -

Afrankart DFK 2 Finger Brass Knuckles Knuckle Duster -Cakra EDC Gadgets

Regular price $USD 44.99Regular priceUnit price per$USD 62.99Sale price $USD 44.99Sale -

Folding Brass Knuckles 440C Stainless Steel

Regular price $USD 20.99Regular priceUnit price per$USD 32.99Sale price $USD 20.99Sale -

420 Stainless Steel Brass Knuckles Self Defense Real

Regular price $USD 20.99Regular priceUnit price per$USD 22.99Sale price $USD 20.99Sale -

2024 New Titanium Brass Knuckle

Regular price $USD 56.99Regular priceUnit price per$USD 86.99Sale price $USD 56.99Sale

Featured Self Defense Jewelry

-

2024 New Cross Self Defense Necklace

Regular price $USD 34.99Regular priceUnit price per$USD 46.99Sale price $USD 34.99Sale -

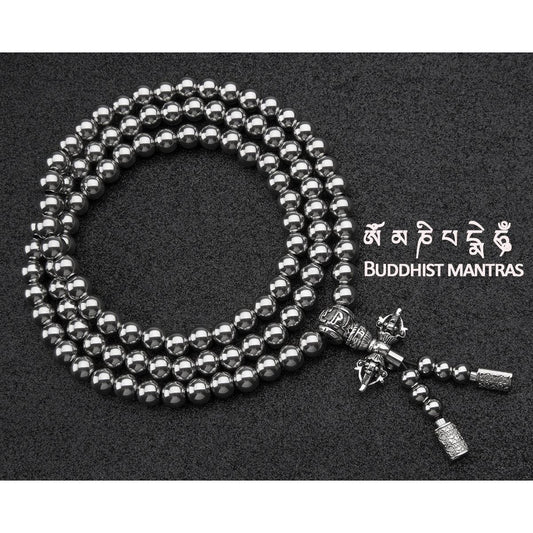

Full Stainless Steel Buddism Mala Self Defense Necklace EDC Defense Tool

Regular price $USD 28.99Regular priceUnit price per$USD 39.99Sale price $USD 28.99Sale -

Mahakala Self Defense Beads Mala Bracelet

Regular price $USD 28.99Regular priceUnit price per$USD 39.99Sale price $USD 28.99Sale -

Dragon Head Full Stainless Steel Self Defense Bracelet Jewelry

Regular price $USD 26.99Regular priceUnit price per$USD 36.99Sale price $USD 26.99Sale

Featured Self Defense Baton

-

Self Defense Tactical Whip With Stainless Steel Hammer Head

Regular price $USD 84.99Regular priceUnit price per$USD 108.99Sale price $USD 84.99Sale -

Self Defense Tactical Whip Stinger Legal Aluminium Alloy

Regular price $USD 28.99Regular priceUnit price per$USD 38.99Sale price $USD 28.99Sale -

Wooden Handle Stinger Self Defense Whip Car Emergency Tool For Women

Regular price $USD 20.99Regular priceUnit price per$USD 28.99Sale price $USD 20.99Sale -

Tactical Self Defense Whip

Regular price $USD 18.99Regular priceUnit price per$USD 28.99Sale price $USD 18.99Sale

Featured Self Defense Kubotan

-

Full 304 Stainless Steel Keychain Defense Baby Tonfa Kubotan

Regular price $USD 28.99Regular priceUnit price per$USD 36.99Sale price $USD 28.99Sale -

Tomahawk TC4 Titanium Kubotan Self Defense Stick

Regular price $USD 26.99Regular priceUnit price per$USD 38.99Sale price $USD 26.99Sale -

Push Dagger EDC Tactical Pen

Regular price $USD 18.99Regular priceUnit price per$USD 25.99Sale price $USD 18.99Sale -

Stainless Steel Self Defense Bamboo Kubotan

Regular price $USD 16.99Regular priceUnit price per$USD 22.99Sale price $USD 16.99Sale

Featured EDC Gadgets

-

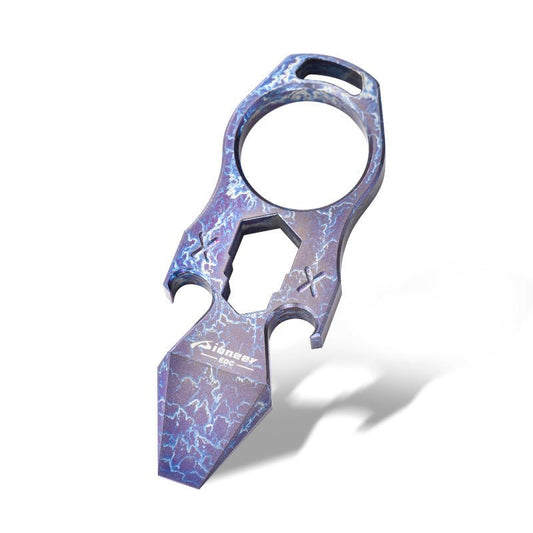

2023 NEW Titanium EDC Self Defense Keychain Multi Tool

Regular price From $USD 34.99Regular priceUnit price per$USD 48.99Sale price From $USD 34.99Sale -

TC21 Titanium Super Hard Tactical Cyclone Dagger Knife - Cakra EDC Gadgets

Regular price $USD 44.99Regular priceUnit price per$USD 64.99Sale price $USD 44.99Sale -

Spiked Brass Knuckles Ring Slingshot 404C Stainless Steel 3 In 1

Regular price $USD 46.99Regular priceUnit price per$USD 66.99Sale price $USD 46.99Sale -

Sale

SaleTauren Push Dagger

Regular price $USD 24.99Regular priceUnit price per$USD 36.99Sale price $USD 24.99Sale